Our Services

The Field-to-Finance Architecture

At SustainGenix, we bridge the gap between high-level policy advisory and ground-level implementation.

Our work is built on a 4-Pillar Forensic Architecture designed to future-proof National Tourism Organisations (NTOs), development partners, and private investors against the 2026 regulatory shift.

Pillar I: Regulatory Readiness & ESRS Integration

Navigating the 2026 Disclosure Mandate

We provide the technical framework for destinations to meet the EU’s 2026 Corporate Sustainability Reporting Directive (CSRD). We move beyond anecdotal reporting to deliver audit-ready data.

Double Materiality Assessments: Identifying both the Impact (how tourism affects the environment and communities) and Financial Materiality (how climate change and biodiversity loss affects your bottom line). ESRS E1-E5 Alignment: Stress-testing destination strategies against specific European Sustainability Reporting Standards for Climate, Biodiversity, and Circular Economy. Transition-Ready Vaults: Developing JSON/CSV machine-readable data structures for immediate integration into the European Tourism Data Space (ETDS).

Pillar II: Physical Resilience & Spatial Auditing

Mapping the Safe Operating Space

Using high-resolution GIS and satellite data, we identify the physical risks to tourism infrastructure before they become stranded assets.

Stranded Asset Risk Index (SARI): Identifying hotels, transport hubs, and heritage sites at risk of losing economic viability before their investment cycles expire. Vulnerability Heatmaps: Utilising Copernicus C3S data to overlay climate hazards (wildfires, sea-level rise, thermal anomalies) onto tourism clusters. Socio-Ecological Thresholds: Defining safe-stress-overshoot zones to protect fragile alpine and coastal ecosystems from irreversible damage.

Pillar III: Carbon Intensity & Transition Risk

Quantifying the Aviation Elephant in the Room

We specialise in Scope 3 (Category 11) emissions, the downstream transport that accounts for the vast majority of a destination's footprint.

Carmacal Logic Integration: Utilising the most popular GHGe emission calculator for EU tour operators, we model emissions-per-Euro-spent across different visitor segments. EU ETS Scenario Modelling: Predicting demand shifts caused by carbon-pricing increases in aviation and maritime transport. Yield-at-Risk (VaR) Analytics: Shifting the focus from visitor arrivals to the economic revenue at risk due to carbon-induced demand shifts.

Pillar IV: Socio-Economic Multipliers & ROI

Proving the Case for Green Investment

We use advanced econometrics to prove that sustainable tourism is an engine for local prosperity, not a cost centre.

ARIMA-Driven Job Modelling: Quantifying the direct, indirect, and induced employment potential of green tourism clusters. Investment Readiness Scorecards (IRS): Evaluating the bankability of tourism products for Foreign Direct Investment (FDI) and Private Capital Mobilisation. GESI-Led Project DNA: Integrating Gender Equality and Social Inclusion metrics into supply-side diagnostics to ensure the transition is equitable.

Strategic Modules for the Green Transition

SustainGenix provides four core technical modules designed to move destinations from climate vulnerability to investment readiness. These services are interoperable with the EU Green Deal (CSRD) and the World Bank GRID framework.

Double Materiality & ESG Diagnostic

The Regulatory Compass

We provide the technical architecture for compliance with ESRS (European Sustainability Reporting Standards). This module helps NTOs and tourism boards navigate the "Double Materiality" mandate.

- Gap Analysis: Aligning existing data with ESRS E1 (Climate) and E4 (Biodiversity).

- Carbon Logic: Implementing the Carmacal engine for high-resolution Scope 3 aviation and transport modeling.

- ESG Manuals: Developing destination-specific SOPs for climate-resilient operations.

GIS Spatial Auditing & Physical Risk Mapping

The Field Blueprint

Using high-resolution spatial data, we audit the physical resilience of tourism clusters against 2030 and 2050 climate scenarios.

- Hazard Overlays: Mapping wildfires, flood zones, and thermal anomalies against high-value tourism assets.

- Stranded Asset Identification: Identifying infrastructure whose economic life is threatened by climate shifts (e.g., ski-lift viability or coastal erosion).

- Adventure Potential Mapping: Utilizing our Himalayan-tested methodology to identify “climate-safe” growth zones for high-yield adventure tourism.

Econometric Modelling & Job Multipliers

The Economic Engine

We quantify the "S" (Social) and "G" (Governance) of ESG through advanced data modelling. This ensures that tourism development is an engine for inclusive prosperity.

- Job Creation Analytics: Utilizing ARIMA and Input-Output models to calculate direct, indirect, and induced employment.

- Demand Forecasting: 10-year arrival and revenue projections under various climate and carbon-pricing scenarios.

- Livelihood Impact: Measuring the “ripple effect” of tourism spending on MSMEs and the informal sector.

Investment Readiness & PPP Structuring

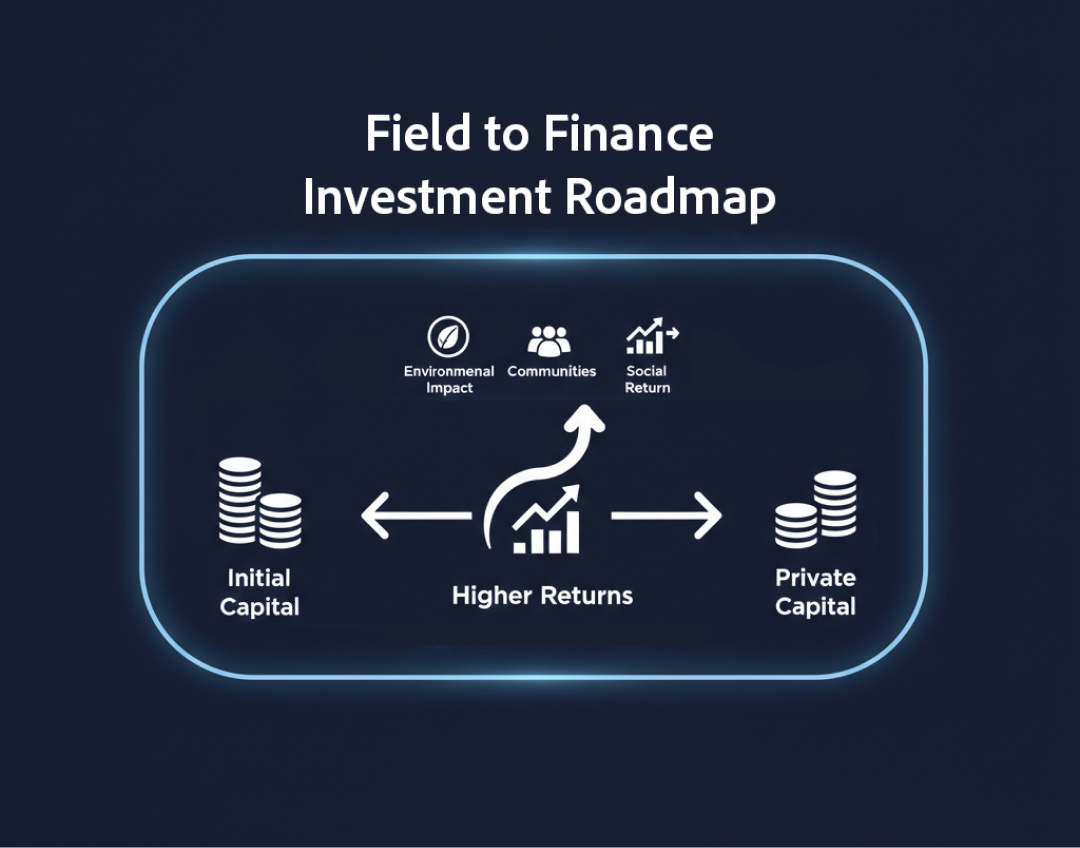

The Finance Bridge

We transform national strategies into bankable investment prospectuses that attract Foreign Direct Investment (FDI) and private capital.

- IRS Scoring: Utilizing our proprietary Investment Readiness Scorecard to evaluate product bankability.

- PPP Frameworks: IDesigning Public-Private Partnership models for green infrastructure (e.g., sustainable energy for remote lodges).

- Investment Roadmaps: Creating “Field-to-Finance” pathways for multilateral donor-funded assignments.

Frequently Asked Questions

Why is the 2026 deadline so critical for NTOs?

What is a "Stranded Asset" in a tourism context?

How does your "Field-to-Finance" approach differ from standard consulting?

Do we need specialised software to use your toolkits?

How do you ensure local communities benefit from this data?

SustainGenix "Service Tiers"

To help institutional clients engage, we offer three clear entry points

Service Level

Delivery Model

Best For

Technical Audit

4-week forensic diagnostic and "Blindspot" report.

NTOs starting the CSRD/ESRS compliance journey.

Strategic Roadmap

Full master-planning, GIS mapping, and FDI prospectus.

National governments and World Bank-led assignments.

Workshop & Synthesis

Interactive "Stress-Test" for boards and MIG members.

Stakeholder alignment and crisis-resilience planning.

Take the First Step

Useful Link

follow us:

Copyright © 2025 sustaingenixgmbh. All Rights Reserved.